How much can i borrow fha loan

While a 401k loan helps you save on interest paymentsyoure paying. 3 20 to avoid private mortgage insurance.

/text-sign-showing-hand-written-words-fha-home-loan-1179800155-9e745cb5bb5f49279651d7a9e76096ac.jpg)

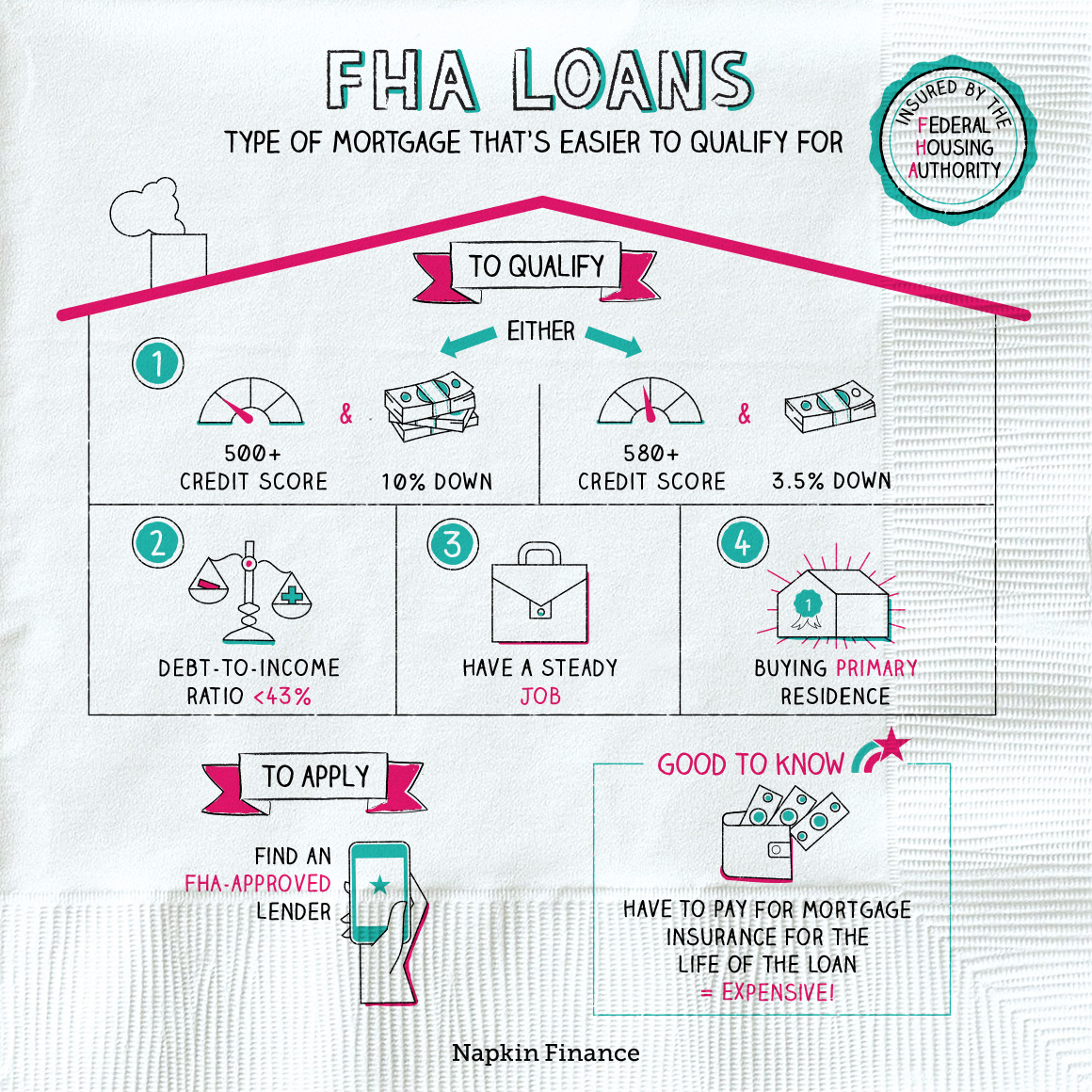

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

This provides a rough estimate of how much you can borrow for a loan.

. A jumbo loan is meant for home buyers who need to borrow more. FHA Loan After Bankruptcy Yes You Can. A minimum of 500 preferably 580.

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. Like home equity loans retirement plan loans can be risky. Ideally 620 and up has flexible credit standards.

In December 2021 the average 30-year US. How expensive of a home can I afford with an FHA loan. In many cases homebuyers can borrow up to 548250 with a VA loan but you may be able to borrow more in areas with a higher cost of living.

The terms of an FHA loan for mobile homes include a fixed interest rate for the entire 20-year term of the loan in most cases. A Federal Housing Administration loan FHA loan is a loan that typically allows you to purchase a home with looser requirements. FHA loans are designed for low-to.

FHA-insured loans are meant to help people with low or no credit high debt or low funds qualify for a mortgage. If you have a 401k plan at work for example your employer may allow you to borrow a portion of it through a 401k loan. The maximum term is 15 years for a lot-only purchase.

FHA LOAN MAXIMUMS FOR MOBILE HOMES MOBILE HOME LOTS AND. The average 30-year Federal Housing Administration FHA loan by contrast was much more expensive with an average interest rate of 339. You can get one with a down payment as low as 35.

Total subsidized and unsubsidized loan limits over the course of your entire education include. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on. CONVENTIONAL LOAN FHA LOAN Minimum credit score.

Borrowers that dont qualify for a conventional loan can pursue the option of FHA loans which are less strict compared to conventional loans. Its a good indicator of whether you satisfy minimum requirements to qualify for a mortgage. 31000 23000 subsidized 7000 unsubsidized Independent.

How Much Mortgage Can I Afford if My Income Is 60000. An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA. Department of Veterans Affairs VA loan carried an interest rate of 299 according to mortgage application processing software company Ellie Mae.

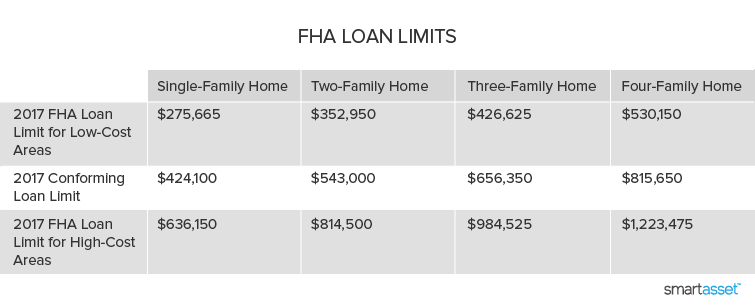

Ability to Borrow Loan Affordability Loan Payments. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. FHA loans are restricted to a maximum loan size depending on the location of the property.

At 60000 thats a 120000 to 150000 mortgage. 500 with 10 down. If youre in a financial bind a 401k loan allows you to borrow from yourself instead of a bank or a credit card.

This mortgage calculator will show how much you can afford. Purchase or refinance your home with an FHA loan. Requiring a lower down-payment and accepting even a bruised credit score FHA are deemed as easier to qualify for compared to conventional ones.

Browse through our frequent homebuyer questions to learn the ins and outs. Simple Refi FHA Reverse. 580 with 35 down.

If your credit score is between 500-579 you may still qualify for an FHA loan with a 10 down payment. Streamline Refi Cash-out Refi Rehab Loan. FHA One-Time Close Loans.

That term can be extended up to 25 years for a loan for a multi-section mobile home and lot. Keep in mind that generally the lower your credit score the higher your interest rate will be which may impact how much house you can afford.

Fha Mortgage Loan Process Checklist Refiguide Org Home Loans Mortgage Lenders Near Me

Is An Fha Loan Good For You Stem Lending

Let S Talk Loan Options Fha Loan Total Mortgage Blog

Fha Loan Requirements And Guidelines

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loans Your Complete Guide Loanry

Fha Loans Napkin Finance

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loans Everything You Need To Know

Fha Loan Limits 2022 Update With County Maximums Smartasset Com

Minimum Credit Scores For Fha Loans

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Fha Loan What To Know Nerdwallet

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference